Japanese sail patterns, strategy and more with ayrex binary options broker

Page 4 of 5

Page 4 of 5 •  1, 2, 3, 4, 5

1, 2, 3, 4, 5

MARUBOZU OPEN BLACK I RECOMMEND YOU TO USEAYREX BROKER

MARUBOZU OPEN BLACK I RECOMMEND YOU TO USEAYREX BROKER

MARUBOZU OPEN BLACK I RECOMMEND YOU TO USE AYREX BROKER

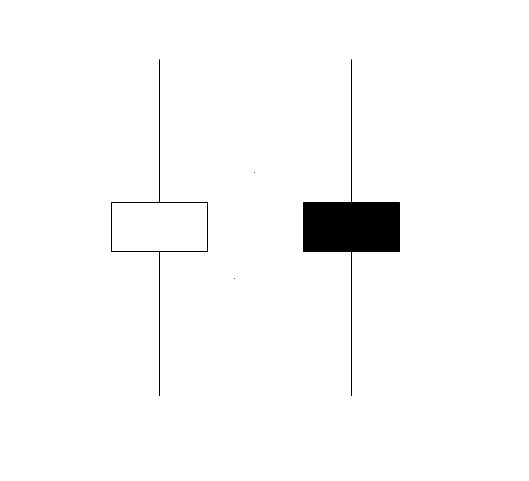

Definition

This type of Japanese candles reflect an extremely bearish market and are characterized by a long black body that does not have a top but lower shadow.

Identification Criteria

1. The body of the candle is black and long in size.

2. It has no upper shadow.

Special Conditions and Flexibility

The body of the black candle should be longer compared to the other candles used in the price chart. It includes a shade in the direction of the closing but lacks shadow in the sense of the opening.

Behavior of the Inverter

A black open Marubozu shows that the sellers controlled the price movements from the first operation until the last of the day. Prices continue to fall steadily, throughout the day, thus forming a black and long day, with no upper shadow. However, prices are not closed with the minimum reached, therefore only a lower shadow is formed.

These types of Japanese candles generally reflect a bearish trend. However, it is of utmost importance to analyze the sail position based on a wider angle of the technical representation. This type of long black candles may refer to a possible turning point and indicate that prices reached a significant support level after a prolonged ascent. On the other hand, if observed at the end of a long and significant decline, this may be a sign of panic or capitulation that reflects a last sale attempt, made before buyers regain control of the market. However, it is not correct to make decisions based on a single Japanese candle, since the candle reflects the price changes of a single stock market.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

MARUBOZU CLOSED BLACK AYREX THE BEST BROKER

MARUBOZU CLOSED BLACK AYREX THE BEST BROKER

MARUBOZU CLOSED BLACK AYREX THE BEST BROKER

Definition

This type of Japanese candles reflect an extremely bearish market and are characterized by a long black body that does not have a lower shadow, but higher.

Identification Criteria

1. The body of the candle is black and long in size.

2. It has no lower shadow.

Special Conditions and Flexibility

The body of the black candle should be longer compared to the other candles used in the price chart. It includes a shadow in the direction of the opening but lacks shadow in the direction of the closing.

Behavior of the Inverter

A Marubozu Cerrado Negro shows that sellers controlled the price movements from the first operation until the last of the day. The prices rise slightly after the opening of the day, thus forming a superior shadow. The opening is followed by a decline that lowers prices below the opening price. The rebound continues until the end of the day, matching the closing price with the lowest price of the day. The sellers are quite strong, except in the initial phase of the session.

These types of Japanese candles generally reflect a bearish trend. However, it is of utmost importance to analyze the sail position based on a wider angle of the technical representation. This type of long black candles may refer to a possible turning point and indicate that prices reached a significant support level after a prolonged ascent. On the other hand, if observed at the end of a long and significant decline, this may be a sign of panic or capitulation that reflects a last sale attempt, made before buyers regain control of the market. However, it is not correct to make decisions based on a single Japanese candle, since the candle reflects the price changes of a single stock market.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

DOJI AYREX BROKER OF BINARY OPTIONS AT THE VANGUARD

DOJI AYREX BROKER OF BINARY OPTIONS AT THE VANGUARD

DOJI AYREX BROKER OF BINARY OPTIONS AT THE VANGUARD

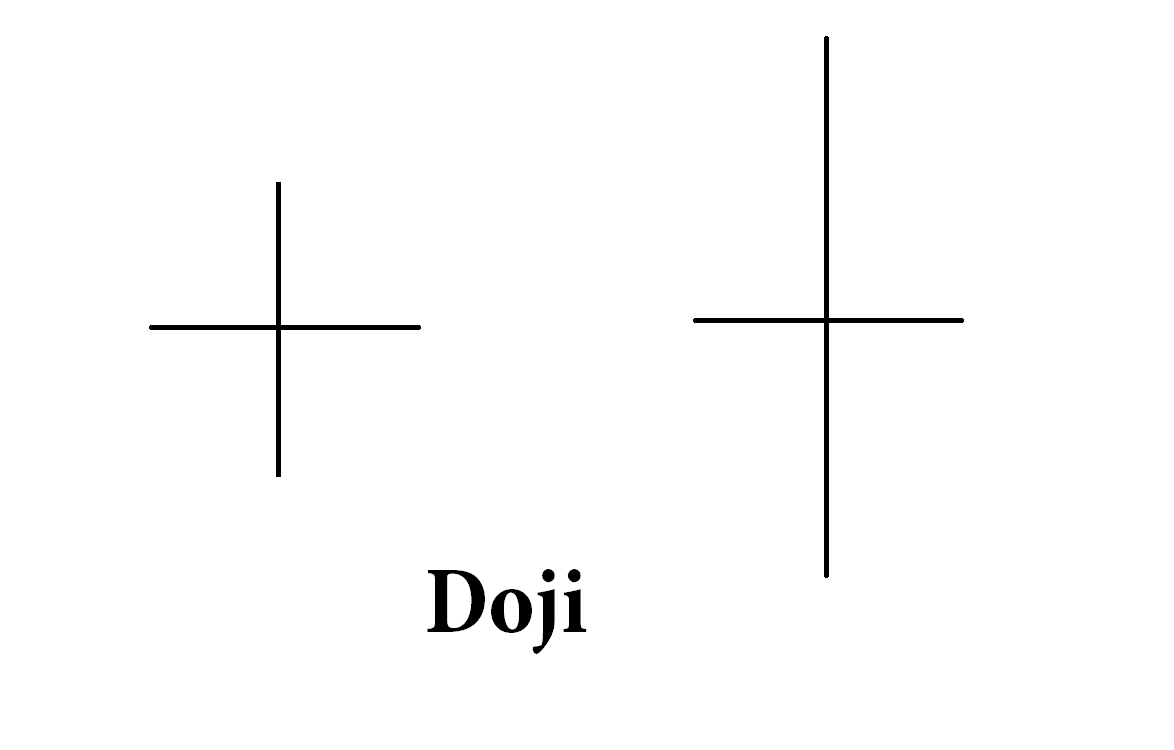

Definition

The candle is formed when the opening price and the closing price are practically the same.

Identification Criteria

1. The length of the body is nil or almost null.

Special Conditions and Flexibility

The ideal would be to build a colorless body without length. However, white, black or near-zero body candles are also considered as Doji.

Behavior of the Inverter

Doji is a particular sign that shows the indecision about the market trend, a balance of forces in the battle between sellers and buyers. This candle reflects that prices have moved above and below the opening price during the day and that the session was closed at a price exactly or practically equal to the opening price. The end result of the Doji is a cease-fire. This shows that neither the buyers nor the sellers were able to dominate the situation, so, it is possible that it will form a turning point in the near future.

The Doji is an important Japanese candle. It provides information both by itself and playing the lead role being a key element in the other formations. It needs to be interpreted according to a previous tendency or previous candles. The appearance of a Doji after an ascent or a long white candle, signals that the pressure on the purchase is weakening. Its appearance after a descent or a long black candle, signals that the pressure on sale is decreasing. The Doji essentially gives us the message that the forces of supply and demand are increasingly balanced and consequently a change in the trend may be close. However, a Doji by itself does not mean enough to identify an investment in the trend or prices. It is necessary to confirm the reversion through the signals emitted later.

The importance of the Doji as a signal is somewhat relative and depends on the characteristics of the market. Actually, it is important only in markets where you can not see many Doji. If there are many Doji in a given chart, the appearance of a new one for that particular market is not very significant and its signal has an insignificant value.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

WHITE PEONZA AYREX THE BEST BROKER

WHITE PEONZA AYREX THE BEST BROKER

WHITE PEONZA AYREX THE BEST BROKER

Definition

This candle has a small white body with shadows at its upper and lower ends that are longer in length than the length of the body. It is accepted as a type of Doji, and when it appears it will act as such.

Identification Criteria

1. The body of the candle is white and of very small size.

2. The upper and lower shadows are longer than the body.

Special Conditions and Flexibility

The white body of the candle should be very small. The lengths of the shadows must be greater than the length of the body.

Behavior of the Inverter

The market fluctuates upwards and then drops sharply, or vice versa. Closing above the opening price creating a small white body. This represents an indecision between bulls and bears. The lengths of the shadows are not relevant. A small body with respect to the shadows is what defines and identifies the top.

If a White Top is observed after a prolonged ascent or a long white candle, this implies weakness among the buyers and is a warning of a possible change or an interruption in the trend.

If a White Top is observed after a long period of descent or a long black candle, this implies weakness among sellers and is a warning of a possible change or a disruption of the trend.

Like most other single-candle patterns, the White Top has little reliability. It only reflects a trading day and can be interpreted as either a continuation of the pattern, or as a pattern reversal. This candle needs to be used with other candles to confirm a trend.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

BLACK PEONZA AYREX THE BEST OF ALL! I RECOMMEND IT TO YOU

BLACK PEONZA AYREX THE BEST OF ALL! I RECOMMEND IT TO YOU

BLACK PEONZA AYREX THE BEST OF ALL! I RECOMMEND IT TO YOU

Definition

This candle has a small black body with shadows at its upper and lower ends that are longer in length than the length of the body. It is accepted as a type of Doji, and when it appears it will act as such.

Identification Criteria

1. The body of the candle is black and of very small size.

2. The upper and lower shadows are longer than the body.

Special Conditions and Flexibility

The black body of the candle should be very small. The lengths of the shadows must be greater than the length of the body.

Behavior of the Inverter

The market fluctuates upwards and then drops sharply, or vice versa. Then, it closes below the opening price creating a small black body. This situation represents an indecision between the bulls and the bears. The lengths of the shadows are not relevant. A small body with respect to the shadows is what defines and identifies the top.

If a Black Top is observed after a prolonged ascent or a long white candle, this implies weakness among the buyers and is a warning of a possible change or an interruption in the trend.

If a Black Top is observed after a long descent or a long black sail, this implies weakness among the sellers and that is a warning of a possible change or the interruption of the tendency.

Like most other single-candle patterns, the Black Peony has little reliability. It only reflects a trading day and can be interpreted as either a continuation of the pattern, or as a pattern reversal. This candle needs to be used with other candles to confirm a trend.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

DOJI OF FOUR PRICES I RECOMMEND BROKER OF OPTIONS BINARIAS AYREX THE BEST

DOJI OF FOUR PRICES I RECOMMEND BROKER OF OPTIONS BINARIAS AYREX THE BEST

DOJI OF FOUR PRICES I RECOMMEND BROKER OF OPTIONS BINARIAS AYREX THE BEST

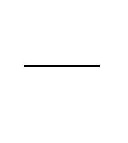

Definition

This candle is defined more simply as a horizontal line without upper and lower shadows.

Identification Criteria

1. The length of the body is zero.

2. It has no upper or lower shadows.

3. The opening price, maximum price, minimum price and closing price are all the same.

Special Conditions and Flexibility

The body must be colorless and the length should be exactly zero. There should be no shadows.

Behavior of the Inverter

A Doji of Four Prices is a fact that very rarely occurs, and that only happens if all four prices are equal. That is, the opening price the maximum price, the minimum price and the closing price end up being the same. It represents the complete and total uncertainty of investors about the direction of the market. It usually occurs when there is a lack of liquidity in the stock market, trading at very low volumes, or when the data source does not report any price other than the closing price.

The Four Price Doji is not reliable by itself, like most other candles. It only reflects a day of quotation and conveys a sense of complete indecision. Actually, it is important only in markets where you can not see many Doji. If there are many Doji in a given chart, the appearance of a new one for that particular market is not very significant and its signal has an insignificant value.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

DOJI OF LONG LEGS IN PRACTICE ALL KNOWLEDGE INAYREX BROKER OF BINARY OPTIONS

DOJI OF LONG LEGS IN PRACTICE ALL KNOWLEDGE INAYREX BROKER OF BINARY OPTIONS

DOJI OF LONG LEGS IN PRACTICE ALL KNOWLEDGE IN AYREX BROKER OF BINARY OPTIONS

Definition

This candle is a Doji with very long shadows.

Identification Criteria

1. The length of the body is zero or almost zero.

2. The upper and lower shadows are very long and are almost the same in length.

Special Conditions and Flexibility

The ideal would be to build a colorless body without length. However, to the sails of white or black body and of near zero lengths, also they are considered like Doji. Both shadows must be long.

Behavior of the Inverter

The Doji with Long Legs is observed when prices have moved above and below the opening price during the day and the session was closed at a price exactly or practically equal to the opening price. This means that the final result is not different from the opening, despite all the enthusiasm and high volatility of the whole day. This implies that in the market there is a loss of the sense of orientation and much indecision. This candle is especially important when caught in market peaks.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

PARAGUAS USA AYREX THE BEST BROKER OF BINARY OPTIONS

PARAGUAS USA AYREX THE BEST BROKER OF BINARY OPTIONS

PARAGUAS USA AYREX THE BEST BROKER OF BINARY OPTIONS

Definition

This candle is a type of Doji that is characterized by not having a superior shadow, but if a lower long shadow. It is also known as Doji Dragonfly.

Identification Criteria

1. The length of the body is nil or almost nil.

2. It has no upper shadow.

3. The lower shadow is long.

Special Conditions and Flexibility

The ideal would be to build a colorless body without length. However, to white or black body candles and near zero lengths, they are also considered as umbrellas. They only have lower shadows and are long.

Behavior of the Inverter

The Umbrella indicates that the sellers have dominated the transactions during the whole day and that they have been able to bring down the prices more. However, buyers reappear successfully at the end of the day, and re-introduce prices at the opening level and highs of the day.

The Umbrella indicates possibilities of upward trend change, if it appears at the end of a prolonged downtrend, a long black candle or if it appears at a significant support level. Similarly, the umbrella may indicate a downtrend, if it appears at the beginning of a prolonged bullish trend, a long white candle, or if it appears at a significant resistance level. The confirmation of the low or the rise is essential in both situations.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

INVERTED UMBRELLA RECOMMENDS AYREX THE BEST BROKER OF BINARY OPTIONS

INVERTED UMBRELLA RECOMMENDS AYREX THE BEST BROKER OF BINARY OPTIONS

INVERTED UMBRELLA RECOMMENDS AYREX THE BEST BROKER OF BINARY OPTIONS

Definition

This candle is a type of Doji that is characterized by not having a lower shadow, but if a long upper shadow. It is also known as Doji Gravestone.

Identification Criteria

1. The length of the body is zero or almost zero.

2. It has no lower shadow.

3. The top shadow is long.

Special Conditions and Flexibility

The ideal would be to build a colorless body without length. However, to white or black body candles and near zero lengths, they are considered as inverted umbrellas. They only have upper shadows and they are long.

Behavior of the Inverter

The Inverted Umbrella indicates that buyers have dominated transactions throughout the day and have been able to raise prices. However, sellers reappear successfully at the end of the day, and re-introduce prices at the opening level and minimums of the day.

The Inverted Umbrella indicates upside trend possibilities, if it appears at the end of a prolonged downtrend, a long black candle, or if it appears at a significant support level. Similarly, the umbrella may indicate a downtrend, if it appears at the beginning of a prolonged bullish trend, a long white candle, or if it appears at a significant resistance level. The confirmation of the low or the rise is essential in both situations.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

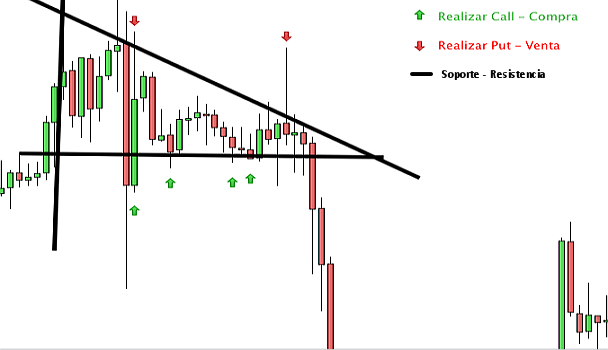

Chartism What is a triangle? Apply in AYREX Binary Options Broker

Chartism What is a triangle? Apply in AYREX Binary Options Broker

Chartism What is a triangle? Apply in AYREX Binary Options Broker

It is a trend-setting chart figure, which occurs when the price curve oscillates in upward or downward movements, these oscillations becoming smaller (except in the inverted triangle, where oscillations are increasing). These oscillations allow drawing a support line and a resistance line, which coincide at one point, forming a triangle, which gives the figure its name. It is interpreted as a trend continuation figure, although sometimes it may not be, and because this figure is unreliable, we should wait for the quote to leave the triangle to act.

The triangular formations are the expression of a market that is in equilibrium between supply and demand, and that is forming a lateral movement of the increasingly narrow quotations. When one of the lines, support or resistance is broken, the equilibrium that had been maintained until then is broken, and the price starts a bullish or bearish race, depending on whether the resistance or the support has been broken. Generally they are formations of trend consolidation, but their low reliability advises to wait for one of the lines to break positions, ie sell if you lose the support or buy if it breaks the resistance.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

With the chartismo can be bought in the minimum and to sell in the maximum? I RECOMMEND AYREX THE BEST BROKER

With the chartismo can be bought in the minimum and to sell in the maximum? I RECOMMEND AYREX THE BEST BROKER

With the chartismo can be bought in the minimum and to sell in the maximum? I RECOMMEND AYREX THE BEST BROKER

No, chartism does not allow to determine the last day of the bullish or bearish tendency to anticipate the change and to be able to sell the last day of the rise, or buy the last day of the descent. The chartismo needs to confirm the figures or signs that determine a change of tendency, for which it has to wait until the ascent or descent begins, to confirm that this tendency will have continuity and to buy or to sell quickly, to be able to take advantage of the rest of The upward or downward trend. For example in a shoulder-head shoulder figure, the sell signal occurs when the clavicle line breaks down, line that is well below the maxima, which are at the peak that makes up the head. In addition, to the required waiting for confirmation of the chartist figure, it is necessary to add the security zone of three percent of the value of the quote, not being able to theoretically confirm the break until it exceeds this level.

Chartism is a graphical trend analysis system, by means of which the trend of the quotes can be determined, and the movements of the quotation curve can be identified when a trend change is prepared, but it never allows determining the maximum trading session in The climbs, or the minimum in the descents.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

What is a wedge? I RECOMMEND THAT YOU OPERATE INAYREX THE BEST BROKER OF BINARY OPTIONS

What is a wedge? I RECOMMEND THAT YOU OPERATE INAYREX THE BEST BROKER OF BINARY OPTIONS

What is a wedge? I RECOMMEND THAT YOU OPERATE IN AYREX THE BEST BROKER OF BINARY OPTIONS

The wedges are very similar figures to the triangles, but unlike these, the two lines that delimit it have the same direction, that is to say the two lines are ascending or the two lines are descending. The wedges are usually accompanied by a decrease in volume during their formation, but once the figure has been completed the volume usually increases.

In the wedges it is interpreted that the quotation will continue in the opposite direction to that indicated by the wedge. This means that rising wedges are a downward trend signal, while downward wedges are a bullish trend. The denomination of bullish or bearish that is given to a wedge, does not correspond with the later tendency of the curve of quotations, but with the form of the figure, that is to say if the vertex of the wedge is oriented upwards is bullish, And if the vertex is oriented downwards, the wedge is bearish.

But wedges like triangles are figures with poor reliability and it is necessary to wait for the quote curve to leave the wedge to act. At that moment the balance between buyers and sellers is broken and the market will mark the new trend, which must be used to buy or sell.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

What is a moving average? I RECOMMEND AYREX THE BEST BROKER

What is a moving average? I RECOMMEND AYREX THE BEST BROKER

What is a moving average? I RECOMMEND AYREX THE BEST BROKER

In the stock markets, both in the stock exchanges and in the futures markets, buying or selling pressure is transmitted directly to the quotes, and therefore they are constantly subject to sudden variations. These variations are those that determine the volatility of the value, or of the market. Therefore, a value with a high level of volatility will present abrupt changes in its prices, which, seen in a chart, translates into large peaks and valleys, known as sawtooth. These movements may make it difficult to assess the true trend (bullish or bearish) of a value. To facilitate the determination of the true trend of a value in the short, medium and long term the moving averages are used, which soften the movements of the quotes and mark the trends of the quotation curve.

The moving average is no more than an arithmetic average that smoothes the quotation curve and becomes a new trend line, allowing us to analyze its start and end. It does not give us an advance of the changes of tendency, but it can confirm them fully when they begin. There are several types of moving averages (weighted, exponential, etc.), but the most commonly used is the arithmetic mean, which is the arithmetic mean of the quotes of a certain number of sessions, with the characteristic that in each new session The first session of the series is deleted in the calculation and the last session is added. For this reason it is called moving average, because it moves following the quotes.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

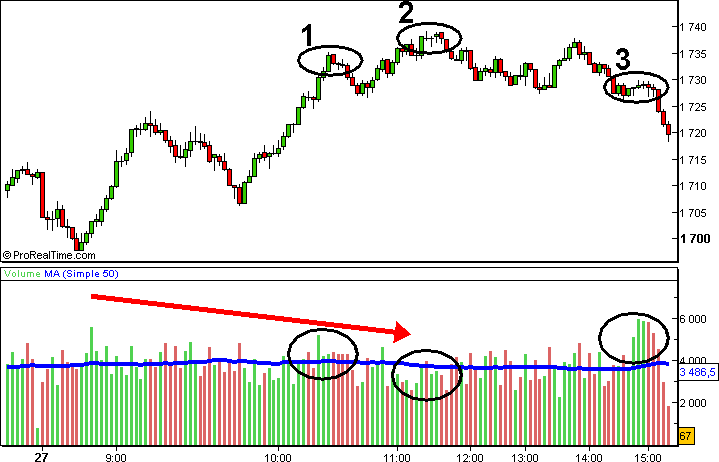

When you give signals of purchase or sale a moving average? I RECOMMEND THAT YOU USE AYREX THE BEST BROKER

When you give signals of purchase or sale a moving average? I RECOMMEND THAT YOU USE AYREX THE BEST BROKER

When you give signals of purchase or sale a moving average? I RECOMMEND THAT YOU USE AYREX THE BEST BROKER

Once we know the moving averages, we will analyze how your buying or selling signals are produced. To do this, the moving average is plotted on the same chart as the quote curve, and the buy signal occurs when the moving average is traversed from the bottom up by the price curve, and on the contrary the sales signal Is produced when the moving average is traversed down by the price curve.

It should be noted that the simple fact that the moving average modifies its curvature is a first sign of attention, but one of the best uses of moving averages is that they act as supports or resistors in the chart, taking into account that The more the number of contacts between the price curve and the moving average much more reliable will be the support function or resistance of the moving average. It is advisable to use the combination of two or three moving averages of different number of sessions, to follow the longest market trend in the long term and use the shortest mean to buy or sell. In this sense it is very important to choose the number of sessions that make up the moving average, the most common being the moving averages of the 10, 70 and 200 last sessions, depending on whether it is operated in the short, medium or long term. A too-short moving average (eg the average of the last 10 sessions to operate in the medium term) produces many false signals, and a too-long moving average (eg the moving average of the last 200 sessions to operate at Medium term) gives signals of purchase or sale too late.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

What is the volume chart? INFORMATION PROVIDED BYAYREX

What is the volume chart? INFORMATION PROVIDED BYAYREX

What is the volume chart? INFORMATION PROVIDED BY AYREX

Generally the quote chart is accompanied by other supplementary charts that help analyze the quote curve. Usually at the base of the quotations chart, and with the same scale of sessions, but with less height, the chart of the turnover is added, that is to say the chart in which the number of titles that have been negotiated in the Session, expressed in number of shares or in money. Graphically, the volume is represented by vertical bars or bars (histogram), whose height is the trading volume of each session. The volume of negotiation is a very important fact in chartismo, because it informs us of the strength and reliability of the movement that makes the quotation, so a high volume ratifies and confirms that movement, while a reduced volume detracts from it.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

How many types of triangles are there? I RECOMMEND AYREXEXCELLENT BROKER BINARY OPTIONS

How many types of triangles are there? I RECOMMEND AYREXEXCELLENT BROKER BINARY OPTIONS

How many types of triangles are there? I RECOMMEND AYREX EXCELLENT BROKER BINARY OPTIONS

Triangles are very common and easy to find chartist formations. They are figures of confirmation of tendency, although in some determined occasions they mark a change of tendency. Triangles can be classified according to their shape into symmetrical triangles; Inverted triangles; Ascending triangles and descending triangles. All triangles occur when the quotation curve oscillates in ascending or descending movements, these oscillations becoming smaller (except in the inverted triangle, where oscillations are increasing). These oscillations allow drawing a support line and a resistance line, which coincide at one point, forming a triangle, which gives the figure its name.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

What is a pull back? I RECOMMEND AYREX THE BEST BROKER OF BINARIAS

What is a pull back? I RECOMMEND AYREX THE BEST BROKER OF BINARIAS

What is a pull back? I RECOMMEND AYREX THE BEST BROKER OF BINARIAS

After completing a figure chartist, the quote quickly rises or falls, depending on the type of figure, but quickly changes direction and returns to its source in a kind of technical reaction. This return movement, is called pull back, and can occur as a pull back. In the case of a bullish escape, the return of the pull back is the ideal moment of purchase, and logically in the case of a bearish figure, pull back is the ideal time to sell, leaving those titles before the fall of the Contributions. The pull back, occurs in the confirmation of almost all chartist figures, and it is a habitual movement, which does not have to infuse suspicion, nor doubts about the main movement of the future trend.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

What is a flag? AYREX GIVES YOU ALL THE INFORMATION ABOUT HOW TO OPERATE THE BEST BROKER

What is a flag? AYREX GIVES YOU ALL THE INFORMATION ABOUT HOW TO OPERATE THE BEST BROKER

What is a flag? AYREX GIVES YOU ALL THE INFORMATION ABOUT HOW TO OPERATE THE BEST BROKER

They are figures of trend consolidation. The duration of these figures is quite short and usually last, at most, two or three weeks. The banderitas tend to be formed in upward trends, and are composed of a sudden rise and with a strong volume, and then the curve of quotations fluctuates slightly downwards, according to two parallel lines, that forms a short and narrow descending channel, taking the appearance Of a small flag. It is a break from the quotations, and in the end the price is again rising.

The flags have two perfectly delimited phases. In a first phase the mast of the flag is formed: the prices rise with great celerity, at the same time that the volume of quotation has great increases. Purchase orders clearly outperform sales orders, and the abundant paper on the market is easily absorbed by the money, the price goes up almost vertically until finally the profit realizations end up holding the bullish momentum. In the second phase, the flag itself is formed: the volume descends notably, especially in the small upward formations within the flag. Finally, in the upward escape, which confirms the figure, and occurs when the small resistance line forming the flag itself is drilled, there is a large amount of turnover, which in turn can serve to Confirm the reliability of the break.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

What is a trend? I RECOMMEND AYREX THE BEST BROKER

What is a trend? I RECOMMEND AYREX THE BEST BROKER

What is a trend? I RECOMMEND AYREX THE BEST BROKER

If we look at the quotes on a chart, we can see that these are moving by trends. This means that for a certain period of time, all of the quotes tend to follow a path that is predominantly upward or downward. If the trajectory is ascending, we say that we are in a bullish trend, whereas if the prices are descending, we are in a downtrend. It may be that the market does not show clear signs of rise or fall. In this case, we speak of a flat market, that is to say that it does not show any particular trend. The analysis and identification of trends and changes in trends is basic in the development of graphic analysis or chartism.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

What is a dormant floor? I RECOMMEND AYREX THE BEST BROKER OF BINARY OPTIONS

What is a dormant floor? I RECOMMEND AYREX THE BEST BROKER OF BINARY OPTIONS

What is a dormant floor? I RECOMMEND AYREX THE BEST BROKER OF BINARY OPTIONS

It is a chartist figure, which indicates a change from downtrend to uptrend, which is produced by a total exhaustion of the downtrend. Of all the ways in which a tendency can vary, this is the less violent and calmer form. It can be considered a particular case and much longer, of another chartist figure: the rounded soil. The dormant soil, formed at the end of a long bearish phase and is a very slow process that requires considerable time, sometimes years, until the figure is completely completed. The best way to detect it is to use long, weekly and even monthly charts.

They are generally formed in second or third row values (chicharros), with reduced contribution volume and must maintain a complete parallelism between quotations and volume. As the price decreases to form the rounded bottom that defines the sleeping floor, the volume of contracting also decreases, which can be reduced to symbolic levels, then slowly increasing the price, the volume will slowly rise until the sleeping floor Awakens, when there is a very strong increase in volume that triggers the upward quotation. The sudden rise in price and volume indicates the end of the figure and the moment of purchase.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

What is free climbing? OPENS WITH AYREX THE BEST OF ALL BROKER

What is free climbing? OPENS WITH AYREX THE BEST OF ALL BROKER

What is free climbing? OPENS WITH AYREX THE BEST OF ALL BROKER

The chartist analysis, in addition to setting the upward or downward trend of the quotations, always tries to set the objectives up or down of that trend, that is, the level at which the quotations will arrive when the trend is totally or partially exhausted. Many chartist figures set their own objectives according to the shape and size of the figure that has been formed, but the most widespread and at the same time most reliable system is to confirm these projections with old levels of resistance or support. That is to say, when a resistance is broken, historical levels of resistance or old supports are looked for in the chart, to accurately fix the level of the new objective to the rise of the quotation. But when the quotation has surpassed its historical highs, the previous reference levels disappear (since all are below the maximum), and consequently it is considered that the quotation is in free rise. In other words, to be in a free rise, it means that the quotation moves in an area where there are no historical resistances or supports, but at no time does it intend to classify this rise as a very strong or long-lasting rise, since there are cases where Free climbs last very few sessions. In the opposite case, when a support is broken, and the quotation falls below historical lows, the quote is said to be in free fall.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

What is a lateral movement? TRY AYREX THE BEST BROKER OF EVERYONE

What is a lateral movement? TRY AYREX THE BEST BROKER OF EVERYONE

What is a lateral movement? TRY AYREX THE BEST BROKER OF EVERYONE

It is a movement of the quotation curve, which moves in a narrow range of fluctuation, practically horizontal, with moderate volumes of business. They are figures of consolidation of trend that allow to leave to the investors more nervous and enter the investors more delayed. They contribute to cleaning up or digesting the excesses that occur when the price curve maintains a bullish trajectory over an extended period of time. The market is reinforced of this movement and confronts more strongly the assault to new highs. In all lateral movement there are, however, concrete societies that evolve the margin of the lateral tendency of the generality of the market and present individual upward or downward movements.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

What is a Shoulder Head Shoulder? THE BEST STRATEGIES WITH AYREX THE BEST BROKER

What is a Shoulder Head Shoulder? THE BEST STRATEGIES WITH AYREX THE BEST BROKER

What is a Shoulder Head Shoulder? THE BEST STRATEGIES WITH AYREX THE BEST BROKER

It is one of the most typical and reliable figures of chartism, and indicates a change of the tendency to bearish. It is consequently a figure of change of tendency. Its name comes from the resemblance of the head and shoulders of a person. It is characterized by beginning with a peak (first shoulder), followed by a second peak higher than the first (head), and ending with a third peak of height similar to the first (second shoulder). In this figure, it is called the clavicle or neckline line to the straight, generally horizontal line, which is formed by joining the lowest point of the descent of the first shoulder with the lowest point of the descent of the head. A clavicle line or descending neckline points to the technical weakness of a title. The symmetry and especially the volume are very important in this type of chartist figure.

The volume develops according to the following sequence: in the first shoulder, the quotient increases always accompanied by an increasing volume and above the average, reaching the first peak, and then suffering a descent with a smaller volume until completing the first shoulder. In the head, the price rises again and the volume must accompany the rise, although in a somewhat lower proportion than in the first shoulder, and in the phase of descent of the head, the volume is low. In the second shoulder, there is the third increase of the quotations, with a weak volume that is maintained in the subsequent fall until forming the second shoulder completely.

At the points of attachment of the head to each of the shoulders, we draw the neckline, and the head-to-toe figure is completed when the fall of the second shoulder cuts this line, adding the three percent margin of Security, we will have the shaped figure. We must not forget the importance of volume in these ruptures, because the volume of business gives us an idea of the strength of the market at the moment of breaking a line of support. If the neckline has been broken with a recruitment volume significantly higher than the previous sessions, the success rate of the figure is very high, in the order of 70 to 90%. If the rupture occurs with a volume equal to or less than the previous sessions, the success of the rupture is scarce.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

When is confirmed a figure chartist? THE BEST INFORMATION WITH AYREX THE BEST BROKER

When is confirmed a figure chartist? THE BEST INFORMATION WITH AYREX THE BEST BROKER

When is confirmed a figure chartist? THE BEST INFORMATION WITH AYREX THE BEST BROKER

To consider that a chartist figure has been confirmed, it is expected to break the line that limits the figure chartist in question and also this break must be higher than three percent of the value of the quote, and can not be taken for granted Theoretically breaking until it exceeds this level. Also, do not forget the importance of the volume in these confirmations. The volume of business gives us an idea of the strength of the market at the moment of crossing a line. If the break line has been broken with a contracting volume significantly higher than the previous sessions, the chance of success of the new trend is very high. If the rupture occurs with a volume equal to or less than the previous sessions, the success of the rupture is scarce and we will have to wait for a new attempt.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

What is a double floor? AYREX THE BEST BROKER OF EVERYONE

What is a double floor? AYREX THE BEST BROKER OF EVERYONE

What is a double floor? AYREX THE BEST BROKER OF EVERYONE

When we are in a bearish phase of the price curve, a double floor is the figure that is formed by two low minimums of the quotation, separated from each other, by a reaction to the rise. It is a figure of change of tendency, usually primary, and is very simple to identify, since it only consists of two consecutive valleys. The time elapsed between both valleys or minima, can vary between several weeks and several months. In general, the more it costs the quote curve to turn, and the longer it takes to complete the figure back, the stronger and more prolonged the subsequent movement. The figure is not completed until the quotation curve, after forming the second valley, exceeds the maximum level of the upward reaction between the two valleys.

These figures are difficult to find in everyday evolution until after some time they become very evident, since at any given time any saw tooth has the appearance of a double floor. There are some small differences between the two double bottom valleys, the second valley or ground is generally rounded and characterized by a very low contracting volume, while the following climb to this second valley is accompanied by A strong increase in volume. On the contrary the volume between the two valleys is very reduced.

You can set a price or target price upward, for the double floor, once it has been completed. The target price is calculated graphically on the chart, the upward movement after the figure being equal to or greater than the height between the minimums of the valley and the upper limit of the upward reaction that separates the two valleys. We could say that the upward reaction is equal to or greater than the "depth" of the double soil.

I recommend you apply everything you learn in this forum on ayrex the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

Page 4 of 5 •  1, 2, 3, 4, 5

1, 2, 3, 4, 5

Similar topics

Similar topics» Trading BO with the indicators on your Android device

» How to Choose a Good Binary Options Broker (broker recommended AYREX:COM)

» Tips for the beginner trader: how to get off to a good start with the binary options "BROKER RECOMMENDED AYREX.COM BROKER"

» The best strategies and broker for binary options 100% checked with ayrex the best broker

» Reviews on ayrex.com the best Binary Options Broker

» How to Choose a Good Binary Options Broker (broker recommended AYREX:COM)

» Tips for the beginner trader: how to get off to a good start with the binary options "BROKER RECOMMENDED AYREX.COM BROKER"

» The best strategies and broker for binary options 100% checked with ayrex the best broker

» Reviews on ayrex.com the best Binary Options Broker

Page 4 of 5

Permissions in this forum:

You cannot reply to topics in this forum|

|

|

Home

Home