Trading BO with the indicators on your Android device

Page 1 of 4

Page 1 of 4 • 1, 2, 3, 4

Trading BO with the indicators on your Android device

Trading BO with the indicators on your Android device

Trading BO with the indicators on your Android device

Dear Traders,We are happy to announce the latest version (4.1.0) of our Android application for "on the go" binary options trading!

The most important development in this app for us is certainly its ability to trade with indicators.

Classic and reliable Bollinger Bands and Moving Averages are already at your service and ready to help with the better analysis.

The great variety of settings allows you to personalize your trading activity and make it as comfortable and efficient as it can be.

Start making more profit with the indicators' help!

Download the latest version of Ayrex mobile application here.

Sincerely yours,

Ayrex Team.

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

Re: Trading BO with the indicators on your Android device

Re: Trading BO with the indicators on your Android device

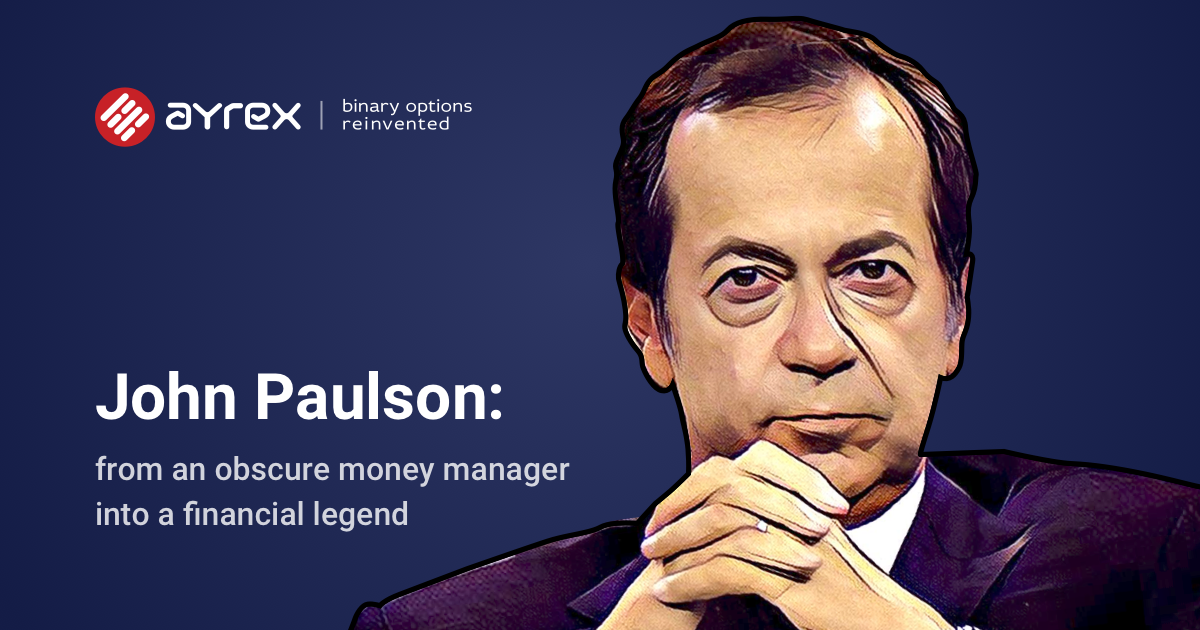

John Paulson: from an obscure manager into financial idol

Dear Traders,

When we are speaking about the most prominent and self-made investors of our age, we definitely can not miss this man. Born in 1955 in New York City John Paulson have gone far on the success path and became one of the most inspirational Ameircan investors, hedge fund managers and philantropists. He is also favourited by publicity and often called as "one of the most prominent names in high finance" and "a man who made one of the biggest fortunes in Wall Street history".

Deliberately choosing finance as his future career, John Paulson enrolled in NYU and became a business student. In 1978 he graduated with honour in finance from New York University's College of Business and Public Administration. Afterwards, he decided to continue his education in Harvard Business School, which he successfully finished in 1980 with a MBA.

His career in finance started shortly after at Boston Consulting Group, where he provided companies with professional advice and thoughtful research. However, his main goal at that time was working on Wall Street and he had decided to achieve it by working at Odyssey partners and Bear Stearns. In 1994 he finally had a chance to found his own hedge fund Pauslon & Co. with $2 only. By 2003 his fund has grown to the phenomenal $300 million in assets.

Paulson's the most favourite drawcard is event-driven arbitrage strategy and let's see why exactly he prefers such style of investment. Quite often this system works by the following scenario: a trader waits and monitors the market for announcement from one company that it is going to buy another one. At that particular moment, a trader rushes to buy the target company's shares, shorting the acquirer's stock and profiting on the difference between two shares prices when the merger is closed.

He became truly famous for his successful bet on the subprime mortgage crisis. A couple of years before the crisis itself, John Paulson began to clearly understand that at that time housing was in a bubble. He began then taking short positions in securities sector, which as he predicted will be the most severely affected when the bubble bursts. Just before the collapse, he started to increse his positions and eventually his fund made more than $15 billion on one suprime bet.

Considering the amazing success story of John Paulson, there are really tons of lessons that we can learn from him, but one of his best trading pieces of advice can be this one: "“Many investors make the mistake of buying high and selling low while the exact opposite is the right strategy to outperform over the long term.”

Which stratedy do you prefer to trade with? Find out on Ayrex!

Sincerely yours,

Ayrex Team.

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

Re: Trading BO with the indicators on your Android device

Re: Trading BO with the indicators on your Android device

Michael Steinhardt - the Wall Street's greatest trader

Dear Traders, Bloomberg called this man the “Wall Street’s greatest trader”, while Forbes estimated his fortune in $1.05 billion in January 2017. Millions of people keep wondering what is Michael Steinhardt’s secret ingredient of success. In the meantime, he is reinventing investing over and over again.

The future "greatest trader" was born in 1940 in New York City. His family was not an easy one: Michael's father was Sol Frank Steinhardt - hot-tempered high-stakes gambler, who had a lot of acquaintances in the criminal world.

Despite the uneasy family background, Michael has always been eager to study and in 1960 he graduated from the University of Pennsylvania. His first steps in finance were made as an analyst and researcher for Calvin Bullock mutual fund company and in the brokerage firm called Loab Rhoades & Co. By 1967 Steinhardt, Fine, Berkovitz & Co. hedge fund company was founded. Steinhardt invested $10000 of his own earnings from investments. The company was very successful due to the special approach implemented by its founder: deep analysis of the macro market situation allowed to adapt company’s strategy to it perfectly. In 1995 Steinhardt made a decision to leave at the top of his career. By this moment the company was worth $4.8 million.

"I thought there must be something more virtuous, more ennobling to do with one's life than making rich people richer," he said. "It's not the sort of thing from which you would go straight up to heaven."

In 2004 Steinhardt began to work in WisdomTree Investments, which focuses on earnings-based index funds.

Steinhardt’s investment style is more about short term strategic trading. According to Charles Kirk, Steinhardt prefers to use several "rules of investing":

- Make all your mistakes early in life. The more tough lessons early on, the fewer errors you make later.

- Always make your living doing something you enjoy.

- Be intellectually competitive. The key to research is to assimilate as much data as possible in order to be to the first to sense a major change.

- Make good decisions even with incomplete information. You will never have all the information you need. What matters is what you do with the information you have.

- Always trust your intuition, which resembles a hidden supercomputer in the mind. It can help you do the right thing at the right time if you give it a chance.

- Don't make small investments. If you're going to put money at risk, make sure the reward is high enough to justify the time and effort you put into the investment decision.

Investing rules can be different for every trader. You can set your own with Ayrex right now!

Sincerely yours,

Ayrex Team.

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

Pairs trading and how to work with it

Pairs trading and how to work with it

Pairs trading and how to work with it

Dear Traders,

In a constant attempt to help our clients to avoid blind trading and to keep it as intelligent as possible, we would like to start a little tradition of posting the basic information and tips about the major trading strategies. We hope that if you are only taking the first steps in discovering the fascinating world of binary options, you’ll find it helpful and interesting, and if you are already a guru, you are welcome to share your own views on the matter.

Being created back in 1980s by the small group of computer scientists, mathematicians and physicists, pairs trading strategy focuses on determining 2 currency pairs with strong historical correlation. Keeping it short, pairs trader monitors performance of both pairs and when one asset starts to move up and another one falls simultaneously, shorts the outperforming asset and longs the underperforming one. In such case, the main profit consists of the spread between them.

Pairs trading brought more than $50 millions to its creators only in the first years and can be considered as one of the most profitable strategies, if you posses the right skills for it. To become successful pairs trader, pay special attention to your position sizing, market timing and decision making skills.

Have you ever tried trading with such strategy? You can always check your trading skills on Ayrex!

Sincerely yours,

Ayrex Team.

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

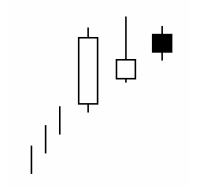

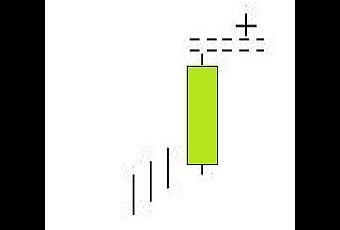

TRIPLE TRAINING WITH GAP AT THE LOOP I RECOMMEND AYREX BROKER OF BINARY OPTIONS THE BEST

TRIPLE TRAINING WITH GAP AT THE LOOP I RECOMMEND AYREX BROKER OF BINARY OPTIONS THE BEST

TRIPLE TRAINING WITH GAP AT THE LOOP I RECOMMEND AYREX BROKER OF BINARY OPTIONS THE BEST

Definition

This is a four-day pattern of a downtrend reversal. It consists of three consecutive days each forming a superior gap in the opening. After Triple Training with Gap to Boom Boom, the market becomes overbought extremely, and is ready for the reverse of the current trend.

Identification Criteria

1. The first day can be white or black.

2. The second day can also be any color, as long as there is a gap between the body of the first day and yours.

3. The last two days are white. The bodies of these last two days must have holes in the direction of the body of the candle of the last day.

2. The second day can also be any color, as long as there is a gap between the body of the first day and yours.

3. The last two days are white. The bodies of these last two days must have holes in the direction of the body of the candle of the last day.

Special Conditions and Flexibility

The first two days of the Triple Training with Gap Upwards can be any color, but the last two days should be white. Between the sails must have exhaust holes up.

Behavior of the Inverter

The market is overbought as a result of three consecutive upside gaps, and it is time to realize profits for those still holding shares.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

BAJISTA TAP ALERT RECOMMEND BROKER OF BINARY OPTIONS AYREX THE BEST OF ALL

BAJISTA TAP ALERT RECOMMEND BROKER OF BINARY OPTIONS AYREX THE BEST OF ALL

BAJISTA TAP ALERT RECOMMEND BROKER OF BINARY OPTIONS AYREX THE BEST OF ALL

Definition

This is a pattern of a bearish reversal of three days. The reason for the development of this pattern is due to the usual events where prices can break very often downwards, especially if the pattern is preceded by a strong upward movement.

Identification Criteria

1. A bullish trend prevails in the market.

2. On the first day a white candle appears.

3. The second and third day each have lower lows and higher lows than the previous day. Its color is not relevant.

4. The sizes of the bodies of the three days are of no importance.

2. On the first day a white candle appears.

3. The second and third day each have lower lows and higher lows than the previous day. Its color is not relevant.

4. The sizes of the bodies of the three days are of no importance.

Special Conditions and Flexibility

The first candle should be a black candle. The other two candles can be of any color and length, but consecutively they should have a series of lower peaks and higher bottoms: (Higher lower and lower high).

Behavior of the Inverter

What is important in the compression of the Bass Squeeze Alert is that the trend rise has slowed down and reached a base level or stock market stability.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: WWW.AYREX.COM

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

THREE BASS INTERIOR BOWLS AYREX BROKER OPTIONS BINARIA

THREE BASS INTERIOR BOWLS AYREX BROKER OPTIONS BINARIA

THREE BASS INTERIOR BOWLS AYREX BROKER OPTIONS BINARIA

Definition

This is a confirmed Bassist Harami pattern. The first two sails are exactly the same as those of Bassist Harami, and the third day represents confirmation of the bearish trend.

Identification Criteria1. A bullish trend prevails in the market.

2. In the first two days a Harami Bassist pattern (or a Harami Cross) is observed.

3. Next, a black candle is seen on the third day with a lower closing than the second day.

Special Conditions and Flexibility2. In the first two days a Harami Bassist pattern (or a Harami Cross) is observed.

3. Next, a black candle is seen on the third day with a lower closing than the second day.

For the first two days a Harami Bassist pattern (or a Harami Cross pattern) must be identified in accordance with all predefined rules. The third day should be a black day with a lower closing price.

Behavior of the InverterThe second day of the Three Inner High Candles already indicates a change in trend since a small body or else a Doji of the second day show that the bullish power is decaying. The third day confirms this fact, but even so, further confirmation is needed for a reversal of the bearish trend.

I recommend you apply everything you learn in this forum on ayrex.com the best binary optionsbroker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

THREE CANDLES OUTSIDE BASS PLAYERS RECOMMEND AYREX binary options broker EXCELLENT BROKER

THREE CANDLES OUTSIDE BASS PLAYERS RECOMMEND AYREX binary options broker EXCELLENT BROKER

THREE CANDLES OUTSIDE BASS PLAYERS RECOMMEND AYREX binary options broker EXCELLENT BROKER

Definition

This is a Confirmed Bass Tournament Pattern. The first two sails are exactly the same as the Low Pass Pattern and the third day represents the pattern confirmation.

Identification Criteria

1. A bullish trend prevails in the market.

2. On the first two days there is a pattern of Low Bandwidth.

3. On the third day there is a black candle with a lower closing than the second day.

2. On the first two days there is a pattern of Low Bandwidth.

3. On the third day there is a black candle with a lower closing than the second day.

Special Conditions and Flexibility

A Low Bandwidth Pattern must be identified with all predefined rules previously. The third day should be a black day with a lower closing.

Behavior of the Inverter

The first two days of the Tres Velas Exterior Bajistas are simply a Bass Boundary Pattern, and the third day, as suggested by this pattern, confirms that the upward trend is over, since a black candle closes with a new minimum in the Last three days. But even so, further confirmation is needed for a reversal of the bearish trend.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

TWO BASS RAVENS, AYREX BROKER OF EXCELLENT BINARY OPTIONS

TWO BASS RAVENS, AYREX BROKER OF EXCELLENT BINARY OPTIONS

TWO BASS RAVENS, AYREX BROKER OF EXCELLENT BINARY OPTIONS

Definition

This pattern is composed of three candles. The black candles on the second and third day represent the two crows perched on the first candle.

Identification Criteria1. A bullish trend prevails in the market.

2. A strong white candle of normal or long size appears on the first day.

3. The second day is a black candle with an upward gap.

4. On the last day another black candle appears whose opening is inside the body of the second day and closes inside the body of the first day.

Special Conditions and Flexibility2. A strong white candle of normal or long size appears on the first day.

3. The second day is a black candle with an upward gap.

4. On the last day another black candle appears whose opening is inside the body of the second day and closes inside the body of the first day.

The Two Crows Bassist pattern should start with a normal or long white candle. This formation is followed by a short black body that opens up forming a bullish gap. The third day is another black body that envelops the second day. The third day can open at the same level of opening of the second day or above this. The last day, it must be closed within the limits of the body of the first day.

Behavior of the InverterA bullish trend is under way and the white sail confirms the continuity of the present bull market. The second day opens a higher level and leaving a gap at the top. Prices fall a little, and a short black candle is observed. The bulls are not alarmed, because even though a black body appears, prices manage to close above the previous day's close. The third day opens at the same level of opening of the second day or above this, dropping all day and closes above the previous closing price. The action of the third day fills the gap of the second day, and shows that the power of the bulls is running out.

I recommend you apply everything you learn in this forum on ayrex.com the best binary optionsbroker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

BLOCKS AYREX LOW BUNDLING IS AN EXCELLENT 5 STAR BROKER

BLOCKS AYREX LOW BUNDLING IS AN EXCELLENT 5 STAR BROKER

BLOCKS AYREX LOW BUNDLING IS AN EXCELLENT 5 STAR BROKER

Definition

This pattern consists of three consecutive white sails in an upward trend with sequentially increasing closures.

Identification Criteria1. A bullish trend prevails in the market.

2. The first day a white candle appears.

3. The next day is another white candle, which opens within the range of the previous day's body, and closes above the closing price of the previous day.

4. The last day is a short white candle, a spinning top or a Doji that forms a gap on the second day.

Special Conditions and Flexibility2. The first day a white candle appears.

3. The next day is another white candle, which opens within the range of the previous day's body, and closes above the closing price of the previous day.

4. The last day is a short white candle, a spinning top or a Doji that forms a gap on the second day.

The first two white candles that appear in the Bassist Deliberation Block should not be short. The second day should open at the same closing price as the first day or below this, while the closing of the second day should be at the same closing price on or before the first day. The formation of the upward gap of the last candle, can be a short white candle or a Doji.

Behavior of the InverterThe two consecutive white sails ensure the upward trend, and the situation seems to favor the bulls. The upward trend attracts more bulls, and the third day opens above the close of the previous day. The third day is also a white day, which makes the bulls more confident about the continuation of the bullish trend. However, a more detailed analysis reveals that the upward trend is showing signs of weakness. The range of each body is shortening each day and on the third day the gaps rise stars, which shows the state indecision market.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

Re: Trading BO with the indicators on your Android device

Re: Trading BO with the indicators on your Android device

BLOCK OF ADVANCE I RECOMMEND AYREX BROKER OF BINARY OPTIONS

Definition

This pattern consists of three consecutive white sails with increasingly higher closures in an uptrend.

Identification Criteria

1. A bullish trend prevails in the market.

2. On the first day a white candle appears.

3. The next two days are white candles where each closing is placed above the close of the previous day, and with openings within the range of the previous day's body.

4. The last two days have relatively longer upper shadows.

2. On the first day a white candle appears.

3. The next two days are white candles where each closing is placed above the close of the previous day, and with openings within the range of the previous day's body.

4. The last two days have relatively longer upper shadows.

Special Conditions and Flexibility

The first candle of a Advance Block should be a normal or long white candle. The following consecutive white sails should open within the range of the previous day's body, and close above the previous day's close. The bodies of the three white sails must become smaller and smaller, while the upper shadows lengthen.

Behavior of the Inverter

A strong white candle is followed by another white candle that closes above the previous closure. As usually happens with two consecutive white sails, the upward trend seems safe and the situation seems to favor the bulls. The strong upward trend attracts more bulls, and on the third day another candle is formed that closes above the closing price of the previous day. With three white candles, it seems as if the bulls dominate the market; However, there are signs of weakness. First, the bodies are getting shorter and shorter, which shows that the state of market indecision is increasing. Secondly, the candles open within the range of the body of the previous day, ie lowering price. Third, the upper shadows are getting longer. While the second and third day are closing at higher highs, the distance between closing prices are shortened. This means that the bullish trend is losing strength and bulls should be cautious.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

THREE BLACK CIRTS AYREX IS THE BEST BROKER OF BINARY OPTIONS. I RECOMMEND IT

THREE BLACK CIRTS AYREX IS THE BEST BROKER OF BINARY OPTIONS. I RECOMMEND IT

THREE BLACK CIRTS AYREX IS THE BEST BROKER OF BINARY OPTIONS. I RECOMMEND IT

Definition

This pattern indicates a strong change in the market. It is characterized by three normal or long candles that decrease in size successively, forming a ladder. The opening of each day is slightly higher than the previous day's closing and prices are progressively closing at the highest minimum levels. The behavior forms a ladder and points to the downward reversal of the trend.

Identification Criteria

1. A bullish trend prevails in the market.

2. There are three consecutive normal or long black candles.

3. Each candle opens inside the body of the candle of the previous day.

4. The candles are closed progressively with new lows below the previous day or at the same level as these.

2. There are three consecutive normal or long black candles.

3. Each candle opens inside the body of the candle of the previous day.

4. The candles are closed progressively with new lows below the previous day or at the same level as these.

Special Conditions and Flexibility

The Three Black Crows consist of three consecutive normal or long black candles. The last two candles must be opened inside the body of the previous candle, and closed at a level lower than the previous closing price.

Behavior of the Inverter

The pattern appears when the market is holding a high price for too long. The market continues to rise and approaches a peak or has already reached its peak. Next, a bearish downward movement is represented by the first black candle. Price erosion continues over the next two days, closing the day with lower prices. Now, the bulls are forced to collect the profits.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

Re: Trading BO with the indicators on your Android device

Re: Trading BO with the indicators on your Android device

THREE MOUNTAINS CEILING AYREX IS THE BEST BROKER OF BINARY OPTIONS

Definition

This is a pattern of three candles that looks like the Evening Star. Appears when the market is in a bullish trend. The white candle of the first day envelops the next small white body, which as a characteristic has a long upper shadow. The pattern is completed with a small black body, which closes above the close of the second day.

Identification Criteria

1. A bullish trend prevails in the market.

2. A white candle is observed the first day.

3. The second day is a white body that opens lower, quoted with a new maximum and then closes close to the minimum reached during the day.

4. The third day is a short black day above the second day.

2. A white candle is observed the first day.

3. The second day is a white body that opens lower, quoted with a new maximum and then closes close to the minimum reached during the day.

4. The third day is a short black day above the second day.

Special Conditions and Flexibility

The Three Lower Mountains Ceiling begins with a strong white candle, followed by a short, white candle that has the lowest opening of the previous one. The second day is quoted with a new high, causing a long upper shadow that is higher than the previous day. The body of this candle is covered by the body of the first day. The last day that is the third day of the pattern, is a short black body that is above the body of the second day.

Behavior of the Inverter

The market is rising, and there is a white day. The next day, it opens unexpectedly on a lower level, however the bulls show their strength and cause new highs during the day. The day is closed at a level close to the opening, which leads to the formation of a short white candle. The strength of the bulls is in doubt, and the state of indecision prevails in the market. The next day a small black body appears showing that the bulls are losing strength.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

Re: Trading BO with the indicators on your Android device

Re: Trading BO with the indicators on your Android device

TWO CUPS IN GAP BAJISTA RECOMMEND AYREX EXCELLENT BROKER

Definition

This is a three candle pattern of a reversal towards the bullish trend. The gap between the soft body of the second day and the black body of the first day represents the bullish gap. The second and third black days represent the two black crows.

Identification Criteria

1. A bullish trend prevails in the market.

2. A normal or long white candle appears on the first day.

3. The second day is a short black candle that opens up a gap in the direction of the trend.

4. On the third day another black candle appears, which opens at the same opening price of the day before or above it, and then closes below the closing price of the previous day, but still above the close of the day. first day.

2. A normal or long white candle appears on the first day.

3. The second day is a short black candle that opens up a gap in the direction of the trend.

4. On the third day another black candle appears, which opens at the same opening price of the day before or above it, and then closes below the closing price of the previous day, but still above the close of the day. first day.

Special Conditions and Flexibility

The Two Crows in Bassist Gap should start with a normal or long black sail. This formation is followed by a short black body that opens up forming a bullish gap. The third day is another black body that envelops the second day. The third day can open at the same level of opening of the second day or above this. The last day, it should close above the body limits of the first day, leaving the gap created between the first and second days still empty.

Behavior of the Inverter

A bullish trend is under way and the white sail confirms the continuity of the present bull market. The second day opens a higher level and leaving a gap. Prices fall a little, and a short black candle is observed. The bulls are not alarmed, because even though a black body appears, prices manage to close above the previous day's close. The third day opens at the same level of opening of the second day or above this, dropping all day and closes above the previous closing price. The two consecutive black bodies show that the strength of the uptrend has been called into question.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

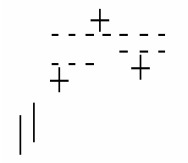

THREE STARS BAJISTAS AYREX BROKER OF BINARY OPTIONS THE BEST

THREE STARS BAJISTAS AYREX BROKER OF BINARY OPTIONS THE BEST

THREE STARS BAJISTAS AYREX BROKER OF BINARY OPTIONS THE BEST

Definition

The pattern is a sequence of three Doji. The appearance of this pattern is extremely rare, so that when it occurs, it should not be ignored.

Identification Criteria

1. A bullish trend prevails in the market.

2. There are three consecutive Doji.

2. There are three consecutive Doji.

3. On the second day gaps are formed downwards between the first and third.

Special Conditions and Flexibility

The Three Bassist Stars consist of three consecutive Doji, in which the second Doji forms upper gap between the other two Doji. It is enough that the gap is the size of a body. There is no need for a gap between the shadows.

Behavior of the Inverter

Three Lower Stars require that there be a market which has been in a bullish trend for a long time. The weakening of the trend is probably indicated by bodies, which are becoming smaller. The first Doji is cause for concern. The second Doji clearly indicates that the market is losing its direction. Finally, the third Doji warns that the bearish trend is ending. This pattern indicates too much indecision, which leads to a reverse of positions.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

BABY ABANDONED BABY RECOMMEND AYREX THE BEST BROKER OF BINARY OPTIONS

BABY ABANDONED BABY RECOMMEND AYREX THE BEST BROKER OF BINARY OPTIONS

BABY ABANDONED BABY RECOMMEND AYREX THE BEST BROKER OF BINARY OPTIONS

Definition

This is a pattern made up of three candles. Indicates an important peak reversal. It is exactly the same pattern as the Evening Star Doji, except for one important difference. As there are gaps between the Doji and the first and third day, gaps are also created above the shadows of the first and third day. His name comes from the second day of the pattern, in which he emerges on the chart by himself, as an abandoned child on the first and third day. Basically, the pattern consists of a white candle followed by a Doji whose distant gap (included shadows) of the days before and after, and the next black candle whose closure is well into the first body of the white candle.

Identification Criteria

1. A bullish trend prevails in the market.

2. A white candle is observed on the first day.

3. On the second day we see a Doji, whose upper shadow forms a gap above the previous candle.

4. The black candle of the third day forms a gap in the opposite direction and without superimposed shadows.

2. A white candle is observed on the first day.

3. On the second day we see a Doji, whose upper shadow forms a gap above the previous candle.

4. The black candle of the third day forms a gap in the opposite direction and without superimposed shadows.

Special Conditions and Flexibility

The Abandoned Child must begin with a white candle, and must continue with a Doji that will form a distant gap between the candles and the shadows. The gap formed between the black candle of the third day and the shadows of the Doji are not relevant. The black candle must close well into the white candle that appears at the beginning of the pattern. The height of the closure, is defined in function of the other two candles belonging to this pattern. The closing of the third day should reach the midpoint between the opening of the first day and the highest point of the body of the second day.

Behavior of the Inverter

A black candle confirms the continuity of the upward trend that is under way. The appearance of the Doji causes a huge gap, indicating that the bulls are still pushing the price up. The price action adjusted between opening and closing shows indecision and reflects the deterioration of the previous trend. On the third day, prices open by forming a downward gap and closing at lower levels. Bears take control of the market.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

Re: Trading BO with the indicators on your Android device

Re: Trading BO with the indicators on your Android device

VESPERTINA DOJI STAR RECOMMENDED TO USE AYREX BROKER OF BINARY OPTIONS

Definition

This is a three-candle pattern that indicates a most important peak reversal. It is composed of a white candle followed by a Doji that typically forms a gap upward to form a Doji star. Then there is a third white candle that covers well into the white body of the first session. This is a significant peak pattern.

Identification Criteria

1. A bullish trend prevails in the market.

2. A white candle is seen on the first day.

3. Then, on the second day you see a Doji that makes gap in the direction of the uptrend.

4. A black candle is observed on the third day.

2. A white candle is seen on the first day.

3. Then, on the second day you see a Doji that makes gap in the direction of the uptrend.

4. A black candle is observed on the third day.

Special Conditions and Flexibility

The pattern of The Evening Star should begin with a white candle, and you should continue with a Doji that opens up forming a gap upward. The black candle that appears on the third day should open at the same or lower level of the body of the Doji, and should close well into the white candle that appears at the beginning of the pattern. The position of this candle is defined in function of the other two candles belonging to this pattern. The closing of the third day should reach the midpoint between the opening of the first day and the upper point of the body of the second day.

Behavior of the Inverter

An upward trend is beginning to be observed, and white sails confirm the continuity of such a trend. The appearance of the Doji accompanied by an upper gap, indicates that the bulls are still raising the price. However, the price action adjusted between opening and closing, shows indecision. On the third day, prices open, leaving a downward gap and closing at lower levels. Bears have taken control of the market.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

BOW BLACK BASE RECOMMEND AYREX BROKER BINARY OPTIONS THE BEST

BOW BLACK BASE RECOMMEND AYREX BROKER BINARY OPTIONS THE BEST

BOW BLACK BASE RECOMMEND AYREX BROKER BINARY OPTIONS THE BEST

Definition

This pattern appears during a bullish trend and consists of a white candle and a black candle in which the black candle opens below the previous day's close and closes below its opening. The pattern is similar to the Harami Bassist pattern. The only difference is that the second day is closed with lower prices, which stops the black body cover by the previous white body.

Identification Criteria

1. A bullish trend prevails in the market.

2. On the first day a white body is observed.

3. The black body that forms on the second day opens lower than the close of the first day, and closes lower than the opening of the first day.

2. On the first day a white body is observed.

3. The black body that forms on the second day opens lower than the close of the first day, and closes lower than the opening of the first day.

Special Conditions and Flexibility

The Black Raven Bassist consists of a white candle followed by a black candle. The length of both candles should not be short. The second day opens below the previous day's close and the closing is below the opening price of the first day.

Behavior of the Inverter

In the market, bulls predominate, and the strong white candle observed on the first day reinforces the position of the bulls. The second day opens lower than the closing price of the previous day, the bulls are alarmed. Prices fall to the point that they close below the opening of the previous day. The bullish trend is outdated. If in the days after prices continue to fall, there would be a very important reversal in the trend.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

BOWL PATCH RECOMMENDED AYREX BROKER OF BINARY OPTIONS

BOWL PATCH RECOMMENDED AYREX BROKER OF BINARY OPTIONS

BOWL PATCH RECOMMENDED AYREX BROKER OF BINARY OPTIONS

Definition

This pattern consists first of a White Marubozu and then a Black Marubozu. After the white Marubozu, the market opens below the previous opening session, forming a gap between the two lines.

Identification Criteria

1. A bullish trend prevails in the market.

2. On the first day there is a White Marubozu (or a white candle) 3. Then on the second day there is a Black Marubozu (or a black candle).

4. The second day begins with a downward gap, thus forming a gap between the body of the first day.

2. On the first day there is a White Marubozu (or a white candle) 3. Then on the second day there is a Black Marubozu (or a black candle).

4. The second day begins with a downward gap, thus forming a gap between the body of the first day.

Special Conditions and Flexibility

The Lower Kick should ideally consist of a White Marubozu, followed by a Black Marubozu and a gap the size of a body between them. However, normal candles that lack body width are also acceptable. Thus, the Separate Bass Patterns pattern, which is a continuation pattern (not included here), is also included with modifications as a reversion pattern.

Behavior of the Inverter

The pattern is a strong signal that shows that the market is heading downward. Appears in a bullish trend, the strong white sail (or a White Marubozu) of the first day confirm the dominion of the bulls. The next day starts with the same opening prices the day before or below them, causing a gap down. This huge gap urges bears to take action. The market raises head by forming a black candle (or a Black Marubozu).

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

HIGHEST COINCIDENTS BAJISTAS RECOMMEND AYREX BROKER OF BINARY OPTIONS

HIGHEST COINCIDENTS BAJISTAS RECOMMEND AYREX BROKER OF BINARY OPTIONS

HIGHEST COINCIDENTS BAJISTAS RECOMMEND AYREX BROKER OF BINARY OPTIONS

Definition

This pattern occurs when two white days appear with an equal close while the market is in a bullish trend. It indicates that a peak (maximum quote) has been reached, even though the new maximum was tested, but there was no follow-up. Which is indicative of a price of good resistance.

Identification Criteria

1. A bullish trend prevails in the market.

2. On the first day a white body is observed.

3. The second day continues with another white candle whose closing price is exactly equal to the closing price of the first day.

2. On the first day a white body is observed.

3. The second day continues with another white candle whose closing price is exactly equal to the closing price of the first day.

Special Conditions and Flexibility

Maxima Coincidentes Bassists consists of two white sails. The length of the first candle should be normal or long. Both candles should close the day at the same level.

Behavior of the Inverter

The market has been on the rise, as shown by the abrupt rise. The next day opens with lower prices, is still quoted with lower, and closed at the same price. This is indicative of short-term resistance and will create great concern in bulls. Which reflects that the psychology of the market is not necessarily the daily quotation movement, but the fact that both days close at the same level.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

AYREX BROKER OF BINARY OPTIONS RECOMMEND AYREX BROKER

AYREX BROKER OF BINARY OPTIONS RECOMMEND AYREX BROKER

AYREX BROKER OF BINARY OPTIONS RECOMMEND AYREX BROKER

Definition

This pattern is a small white body contained by a previous white body. It resembles the Harami pattern, except that both bodies are white.

Identification Criteria

1. A bullish trend prevails in the market.

2. On the first day a white body is observed.

3. On the second day, one sees again a white body that is covered in its entirety by the body of the first day.

2. On the first day a white body is observed.

3. On the second day, one sees again a white body that is covered in its entirety by the body of the first day.

Special Conditions and Flexibility

The Descending Falcon consists of two white sails, in which case the white body of the first day envelops the next white body. The first of the candles has to be a normal or long white candle. The two candles may be at the same level, either at the upper ends of the body or at the lower ends, but in any case, the body of the second day must be smaller than the first.

Behavior of the Inverter

This pattern is a sign of discrepancy. In a market characterized by a bullish trend; In the first place, you see large purchases indicated by the white body of the first day. However, a small body that appears on the second day, points to the decrease in energy and enthusiasm of buyers; Therefore, suggesting a reversal of the trend.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

BAJIST FOUND LINES RECOMMEND AYREX BROKER OF BINARY OPTIONS

BAJIST FOUND LINES RECOMMEND AYREX BROKER OF BINARY OPTIONS

BAJIST FOUND LINES RECOMMEND AYREX BROKER OF BINARY OPTIONS

Definition

This pattern occurs during a bullish trend. The white candle of the first day is followed by a black candle that starts strongly, and closes the day at the same level as the closing price of the previous session. It is similar to the Pattern of Penetrating Pattern. However, the amount of second day rebound prices is different. The second day of Penetrating Tariff closes above the midpoint of the body of the first day, while the second day of Penetrated Lines Closes the same as the first day. Consequently, the Penetrant Guideline is a more significant peak reversal. However, Risers Found Lines should also be taken into account.

Identification Criteria

1. A bullish trend prevails in the market.

2. The first day you see a black candle.

3. Next, on the second day a white candle is observed.

4. The closing prices are the same or almost the same on both days.

2. The first day you see a black candle.

3. Next, on the second day a white candle is observed.

4. The closing prices are the same or almost the same on both days.

Special Conditions and Flexibility

The Lines Found Up consists of two candles: first a black candle, then a white candle; None of it should be short. The closing prices of both days, must be equal or almost equal.

Behavior of the Inverter

The appearance of this pattern reflects a stagnation between bears and bulls. The market is in a bearish trend when a strong white candle is formed, which further supports the trend. The next day it opens with a strong descent, causing the bulls to feel more secure. Then the bears begin a contract that pushes the prices towards the rise and causing a closure equal to or very close to the previous closing. The bullish trend is outdated.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

STAR DOJI BAJISTA RECOMMEND AYREX BROKER OF BINARY OPTIONS.

STAR DOJI BAJISTA RECOMMEND AYREX BROKER OF BINARY OPTIONS.

STAR DOJI BAJISTA RECOMMEND AYREX BROKER OF BINARY OPTIONS.

Definition

This pattern appears in a bullish trend and warns that the trend will change. It consists of a white candle and a Doji with an opening that forms a gap upwards. If the Doji is in the form of an umbrella the pattern is called "Doji Dragonfly Bassist". In the case of an Inverted Umbrella is called "Doji Bullish Bullish". On this page, all these models are included under the name: "Star Doji Bassist", regardless of the shape of the Doji.

Identification Criteria

1. A bullish trend prevails in the market.

2. On the first day a white candle is observed.

3. Next, on the second day we see a Doji with a gap up.

2. On the first day a white candle is observed.

3. Next, on the second day we see a Doji with a gap up.

Special Conditions and Flexibility

The Star Doji Bassist should start with a normal or long white candle. You should continue with a Doji with upward pit formations.

Behavior of the Inverter

The market is in a downtrend, and the trend is confirmed with a strong white candle. The next day it starts by forming a gap on the rise and the quote has a small average range. The session is closed with a price close to the opening, causing the formation of a Doji. Bulls dominated during the uptrend, however a change is now tacit with the appearance of a Doji Star, which shows us that bulls and bears are in balance. The energy of the bullish trend is dissipating. Things are not favorable for the continuation of a bull market.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

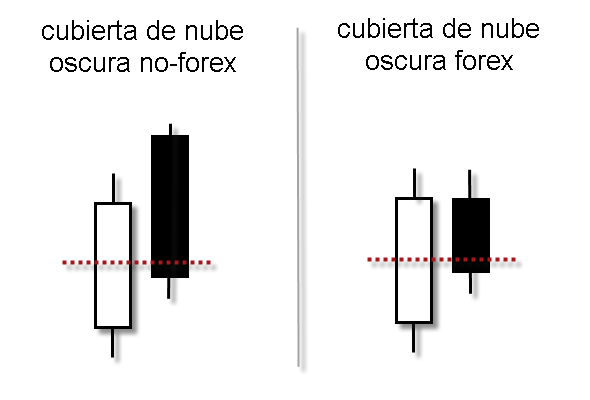

DARK CLOUD COVER BAJISTA RECOMMEND AYREX BROKER OF BINARY OPTIONS

DARK CLOUD COVER BAJISTA RECOMMEND AYREX BROKER OF BINARY OPTIONS

DARK CLOUD COVER BAJISTA RECOMMEND AYREX BROKER OF BINARY OPTIONS

Definition

This pattern is a reverse from the peak of two candles. A white candle appears on the first day, while a bullish trend is in progress. The second day opens with new highs, upward gap and close to more than half within the previous white body, leading to the formation of a strong black candle.

Identification Criteria1. A bullish trend prevails in the market.

2. The first day a white candle appears.

3. A black candle opens on the second day with an upward gap and closes more than half inside the body of the first day.

4. The second day does not manage to close completely under the body of the first day.

Special Conditions and Flexibility2. The first day a white candle appears.

3. A black candle opens on the second day with an upward gap and closes more than half inside the body of the first day.

4. The second day does not manage to close completely under the body of the first day.

On the first day of the Lower Dark Cloud Cover pattern a normal or long white candle is observed. The second day should start well above the close of the first day, thus creating a gap and closing more than half within the body of the previous candle. However, the closing of the second day should remain inside the body of the first day.

Behavior of the Inverter

The market is moving in a bullish trend. The first white body reinforces this view. The next day the market opens with maxima forming gaps at the top, demonstrating that the dominion of the bulls persists. After this very bullish opening, the bears decide to take the initiative. The market is encouraged to close, as a result, prices begin to fall below the level of the previous day. Now the bulls are losing credibility and are reconsidering their positions towards the purchase. Potential sellers uncovered, begin to think that the new highs can not be maintained and maybe it is time to make purchases in the open.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

STAR BAUGHT FUGAZ RECOMMENDED AYREX EXCELLENT BROKER OF BINARY OPTIONS

STAR BAUGHT FUGAZ RECOMMENDED AYREX EXCELLENT BROKER OF BINARY OPTIONS

STAR BAUGHT FUGAZ RECOMMENDED AYREX EXCELLENT BROKER OF BINARY OPTIONS

Definition

This pattern consists of a white body followed by an Inverted Hammer characterized by a long upper shadow and a small body. It is similar in form to the Bullish Inverted Hammer pattern, but unlike the Fugitive Star appears in a bullish trend and signals a reversal of the downward trend.

Identification Criteria

1. A bullish trend prevails in the market.

2. The first day of the pattern is a small white candle.

3. On the second day a small body is observed at the lower end of the quotation range. The color of this body is not relevant.

4. The upper shadow of this second candle should be at least twice as long as the body.

5. Has very little or no lower shadow.

2. The first day of the pattern is a small white candle.

3. On the second day a small body is observed at the lower end of the quotation range. The color of this body is not relevant.

4. The upper shadow of this second candle should be at least twice as long as the body.

5. Has very little or no lower shadow.

Special Conditions and Flexibility

The Inverted Hammer body should be small. The upper shade should be at least twice as long as that of the body, but not shorter than the length of a median candle. It is convenient that there is no shadow or a very small lower shadow. The upper end of the Inverted Hammer must be higher than the body of the previous sail.

Behavior of the Inverter

The pattern occurs during a bullish trend. A white candle that appears on the first day further supports the upward trend. On the second day, in which an Inverted Hammer is seen, the market opens at or near its minimum. Then the prices change direction and go to the promotion. However, the bulls do not manage to maintain the ascent for the rest of the day, and finally the prices close at or near the day's low. Certainly, this causes a concern for any bull that maintains profitable positions.

I recommend you apply everything you learn in this forum on ayrex.com the best binary options broker

Links: AYREX

oficial-Ayrex- Posts : 253

Join date : 2017-01-13

Page 1 of 4 • 1, 2, 3, 4

Similar topics

Similar topics» Is Metatrader a very nice platform to learn trading ?

» currency trading

» CFD Trading by IFC Markets

» Japanese sail patterns, strategy and more with ayrex binary options broker

» Proven Winner Fapturbo 2.0 with Live trading results

» currency trading

» CFD Trading by IFC Markets

» Japanese sail patterns, strategy and more with ayrex binary options broker

» Proven Winner Fapturbo 2.0 with Live trading results

Page 1 of 4

Permissions in this forum:

You cannot reply to topics in this forum

Home

Home